Do you know why your sales team is winning and losing deals?

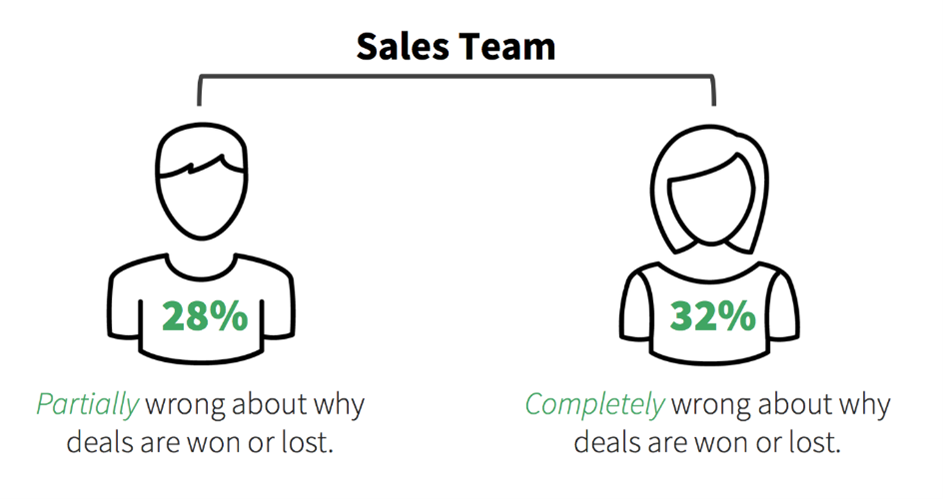

Are you sure? Is your understanding based on data and feedback from prospects, or from sales team members? According to win-loss leader Clozd, about 60% of sales reps are wrong about why they won or lost a deal.

*Image via Clozd

The data is clear; organizations can’t simply rely on secondhand feedback from sales. They need direct insight into what their customers and prospects are thinking to improve their sales process.

By establishing a win/loss program within your organization, you can get key feedback that can help you:

-Drive product roadmap strategy and development. Which features are you missing? Which of these features would make customers choose you instead of your competitors? Use the insights your reps receive to build better products.

-Improve your sales process. What do prospects really think of your sales reps? Are they too pushy? Knowledgeable about the product? How can they improve their relationship and communication skills? Take these insights and address gaps in your current sales training to better equip reps.

-Increase win rates. Once you understand why you’re losing deals, you can make changes to your messaging, positioning, strategy, and more to fix what your customers say is broken, ultimately leading you to lose fewer deals—and win more!

-Understand your position in the market. Is your product as well received as you think it is? Do you have brand recognition in the market? In what ways are your competitors ahead of you? You can learn these things through prospect feedback and automated win-loss follow-ups.

Win-Loss with SugarCRM

Now that you understand what you can do with win/loss data, let’s look at how you can use Sugar Sell (or Enterprise on-premises) and Sugar Market to track these metrics and automate your data collection process.

First, you’ll want to get approval and buy-in from several departments. I suggest starting with your sales operations (or CRM admin), sales leadership, product marketing, and customer experience teams. One low-cost example of how you could run the process is as follows:

- Get approval and buy-in from sales leadership and enable sales on what each win/loss reason means.

- Then, get your CRM admin/sales ops to work with sales leaderships to build out a custom field in Sugar Sell/Enterprise.

- Loss reasons could include things like pricing, missing features, lack of exec buy-in, etc.

- Win reasons could include things like sales experience, support, pricing and packaging, feature set, etc.

- Work with your team to determine these inputs.

- Once sales marks a deal closed “Won” or “Lost,” they should input the relevant win/loss reasons into the customizable Sell/Enterprise field. I suggest making this a required field to obtain the most data from sales.

- Then comes the part where your customers weigh in. Once a deal is marked closed, you can set up an automated workflow that includes a synced field between Market and Sell, then use SugarBPM (Sugar’s business process automation solution) to build a nurture sequence based on this field. As part of this sequence, set up an email trigger from Sugar Market that links to a third-party survey tool of your choice for additional feedback. Deploying a survey directly from Sugar Market is also an option to write win/loss data from the survey back into the CRM, but this would involve a few additional steps.

- In your survey, you can ask more detailed questions about the customer’s decision, but I recommend keeping it to fewer than five questions for maximum response rate. Three questions is ideal. You can ask things like “Why did you choose this solution over a competitor?” to wins or “What could we have done better?” to losses. Clear multiple-choice answers are key here, and they should be based on previous feedback your team has received.

- You may also choose to offer an incentive as part of the survey process, providing customers who complete the survey with gift cards to popular online or in-person retailers (Amazon and Starbucks are personal favorites). This process can be automated through many (paid) 3rd party gift providers, or your marketing team can send these incentives out individually shortly after each survey is completed.

- Your product marketing or customer experience team may also be interested in following up with customers to learn more about their experience beyond simple survey feedback. In this case, I suggest adding a question to your survey to gauge the prospect’s interest in a follow-up meeting.

- To track your responses and progress over time, I suggest an assigned marketing group (typically product marketing or customer experience) collect win/loss feedback from Sugar Sell/Enterprise and your third-party survey tool at least once a quarter. Then, funnel that data up to sales leadership, marketing, product, and interested executives for added visibility. You may want to build your own dashboards to expose common win/loss reasons and trends and provide key metrics at a glance. As a reminder, you can use this data in the following ways:

- Marketing: inform competitive analysis documents, marketing campaigns, messaging, and more.

- Sales leadership: better direct teams, improve sales processes, and create more effective enablement.

- Product: build roadmaps that accurately reflect the market and competitive landscape and prospect and customer sentiment.

Win/loss has a lot of moving parts, but getting this crucial information is priceless.

Want to learn more about why it’s important for sales and marketing to work together? Get the guide, here. For more information on how Sell/Market fit your organization’s unique use cases, contact your Sugar representative today.