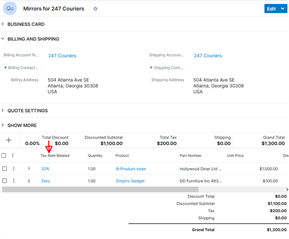

Has anyone else looked into implementing different Tax rates at product level, to subsequently use these within Quoted line items module?

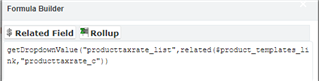

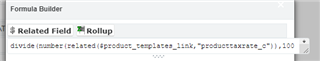

The Product Catalogue module currently only has a dropdown to identify if a product is either Taxable or Non-Taxable, no filed to select which tax rate.

By the way, as we cannot even create the relationship between Product catalogue and Tax module as it's not in Studio, does anyone know how to expose this module to make use of it in Studio?

Many thanks